Avoid penalties. Please check if a German subsidiary is required to disclose information on its beneficial owner(s)

1. Overview

As of 1 October 2017 the recent amendment of the German Money Laundering Act (Geldwäschegesetz, “GWG”) introduced the Transparency Register (Transparenzregister), as to which German entities are required to submit information on their beneficial owner(s).

This post sketches an overview on the transparency requirements specifically for German subsidiaries or shareholdings, i.e. German entities with non-German shareholder(s).

2. The Transparency Register

The Transparency Register is part of the amendment of the German Money Laundering Act in 2017 and derived from EU directives aiming for the prevention of money laundering and financing of terrorism as well as for discovering and prosecute financial crimes.

The Transparency Register is an online register under www.transparenzregister.de

3. beneficial owner

Regardless of the nationality of the shareholders, each German entity is required to identify its beneficial owner(s). The Transparency Register shall inform on the natural persons who ultimately stand behind the entity. In order to determine whether or not a person is a beneficial owner, it is not only the legal shareholding to be considered but moreover the direct or indirect ability to control the entity.

Pursuant to section 3 GWG a beneficial owner is any natural person, who directly or indirectly

(a) holds more than 25% of the shares; or

(b) controls more than 25% of the voting rights or

(c) is able to exercise control over the entity in a similar manner (e.g. a trustor).

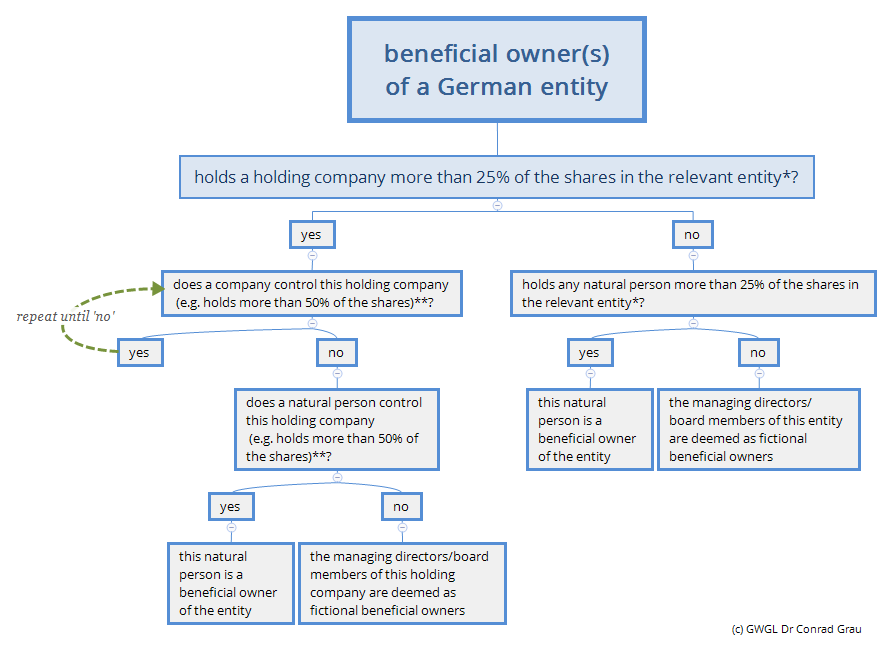

In case of indirect shareholdings (e.g. multi-tier shareholdings like holding and subsidiary structures) the chain has to be followed up to the natural person who ultimately controls the 25+% shareholder of the entity (Sec. 3 para 2 GWG).

4. Managing directors as fictional beneficial owners

There might be cases in which no of the many shareholder holds more than 25% of the shares in the entity (Example: five or more equal shareholders). In such a case the GWG fictionally deems the persons who represent the entity by law (managing directors/board members) as beneficial owners.

The same applies to multi-tier structures. If no controlling shareholder of the holding company can be identified, the managing directors of the holding company are fictionally deemed as beneficial owners of the subsidiary.

The following diagram on how to determine the beneficial owners in many (simple) cases:

*or any other form of control (see above para 3), e.g. trusts, pool agreements on voting rights etc.

** or any other form of control

Please note that this diagram is simplified and may not apply to specific cases.

5. Split shareholdings

If one ultimate natural person holds directly and/or indirectly multiple shareholdings in the entity, such shareholdings have to be added in order to determine, whether this person is a beneficial owner.

Example: A holds directly 10% of the shares in the entity and 100% of the shares in the A-Holding. The A-Holding holds 20% in the entity. Although each shareholding individually stays below the 25% threshold, A is to be deemed a beneficial owner of the entity as the sum of his direct and indirect controlled shareholdings exceeds 25%.

6. Disclosure exemptions

If the information on the beneficial owner(s) required by the Transparency Register (see below) is already registered in other German registers (such as the Commercial Register (Handelsregister)), the entity is not required to proactively disclose such information to the Transparency Register. However, this exception applies only to information registered at German registers only.

Example A: The Danish citizen A (natural person) holds 30% of the entity, which is a German GmbH. The list of shareholders for this GmbH – as registered with the (German) Commercial Register – already identifies A as relevant shareholder. Hence, the German entity does not need to actively file A as beneficial owner to the Transparency Register.

Example B: The Singapore corporation X Limited holds 30% of the German entity (a GmbH). The Individual B, a Maltese citizen, holds 60% of the shares in X Limited. The German commercial register shows X Limited as shareholder. But no German register shows B as controlling shareholder of X Limited. Hence, the German entity is required to disclose B as beneficial owner to the Transparency Register.

7. Obligations of the beneficial owners

The German Money Laundering Act (GWG) imposes an obligation of each beneficial owner to provide the (directly or indirectly) controlled entity with information on its capacity as beneficial owner. The failure to do so may result in penalties imposed by the authorities (see below).

8. Penalties

Infringements of the disclosure obligations may be sanctioned with penalties up to EUR 100,000 and in case of repetitive infringements up to 1,000,000. Such penalties may not only be imposed against the entity but may also be addressed to its managing directors or board members.

9. Who has access to the Transparency Register?

The Transparency Register is not a public register. It may be accessed by authorities, the entity itself, and anyone with a “legitimate interest” only. For the time being the legislator has not been issued any guideline, as to what shall be deemed a legitimate interest.

10. What information will be disclosed?

The Transparency Register lists

- full name

- date of birth

- place of residence

- type of the beneficial ownership

- extent of the beneficial ownership

For further information please do not hesitate to contact us.